Beckway Insights: How US Chemical Companies Can Respond To Tariffs

The federal government’s stop-and-start approach to tariffs has made the first few weeks of 2025 challenging for US chemical manufacturers. Now that higher tariffs have been imposed across a wide range of goods (despite some exemptions and a pause), it is imperative for executives to develop a comprehensive response plan.

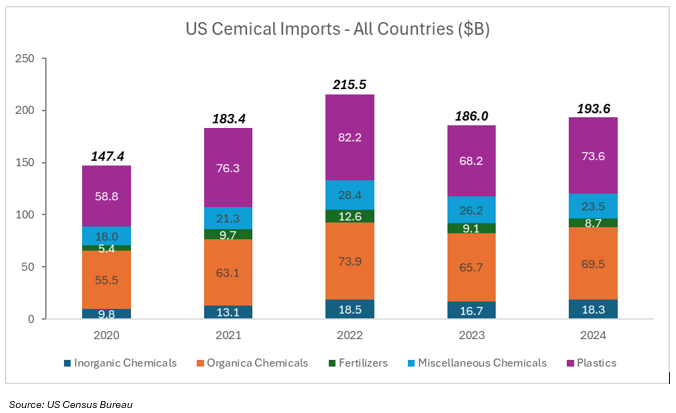

The first question an executive might ask is, “How bad could tariffs be for my business?” Based on the charts below, the answer is: “Potentially quite bad.”

The Tariff Impact

Over the past five years, the United States has imported between $147 billion and $215 billion worth of chemical and related products, with organic chemicals and plastics comprising ~75% of all chemical imports. The American Chemical Society estimates that more than half of these imports go directly into manufacturing. Significant tariffs on these products will translate into higher costs for many US chemical producers.

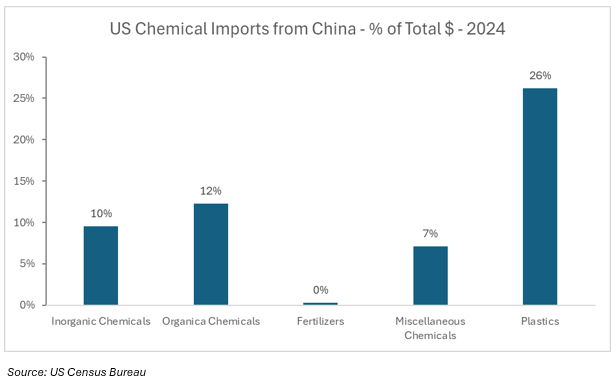

Companies that rely heavily on Chinese imports are particularly exposed, as China has been singled out for some of the highest tariffs. As the chart below shows, China is a major chemical exporter to the US—especially in Plastics.

Beckway’s Comprehensive Response Plan

Beckway, an operating partner for Private Equity-owned portfolio companies, is helping US chemical companies mitigate the impact of tariffs through strategic adjustments in:

- Procurement

- R&D & Product Development

- Manufacturing

- Sales & Finance

Procurement Strategies

- Create physical hedges: Companies may be able to purchase excess inventory before tariffs take effect, securing cost advantages. Firms importing from multiple countries should evaluate tariff differences to determine the most cost-effective sourcing strategy.

- Qualify new suppliers: Businesses that previously concentrated volume with one or two suppliers may need to diversify sourcing to ensure adequate supply and minimize cost impacts.

- Review specifications: Many companies use over-specified (“gold-plated”) input materials that increase costs without adding value. Reviewing and adjusting specifications can unlock savings.

- Negotiate cost-sharing: While US-based customers will ultimately bear the cost of tariffs, US chemical companies should explore cost-sharing negotiations with suppliers. Suppliers with heavy US market exposure may be open to shared tariff absorption.

R&D & Product Development

- Identify alternative input products: R&D teams should evaluate reformulation opportunities to reduce reliance on tariffed materials.

- Adjust specifications: By broadening supplier eligibility, companies can tap into more cost-effective sourcing options. This may require process modifications to accommodate alternative inputs.

Manufacturing Efficiencies

- Improve yields: With rising input costs, maximizing process efficiency is more critical than ever. Companies should fine-tune process controls to reduce material losses.

- Optimize production planning: Chemical manufacturers must prioritize locally sourced materials and utilize an optimized planning wheel for seamless production transitions.

- Enhance Overall Equipment Effectiveness (OEE): A clear, accurate definition of OEE is essential to uncover efficiency opportunities.

- Reduce operating costs: Companies should adopt aggressive cost-cutting strategies, such as top-down reductions (e.g., 20% cost-cutting targets) or zero-based budgeting to identify and eliminate unnecessary expenses.

Sales & Finance Adjustments

- Refine product costing: Many companies lack precise cost visibility, making targeted price increases difficult. Improved cost models ensure strategic pricing adjustments rather than broad, margin-eroding increases.

- Execute strategic price increases: Even with operational improvements, some costs must be passed on to customers. A proactive pricing strategy—including contract reviews and clear customer communication—helps businesses maintain both profitability and market share.

Act Now to Protect Your Margins

Higher tariffs pose serious risks, but a proactive strategy can mitigate financial disruption. By leveraging Beckway’s comprehensive tariff response plan, US chemical companies will be better positioned to adapt, compete, and grow profitably despite rising costs.

Contact our Chemical Industry Lead, John Fuller, to discuss your strategy.